Receiving a GST/HST audit notice from the Canada Revenue Agency (CRA) can feel overwhelming, but with a clear and proactive approach, you can navigate the process effectively. This guide outlines the key steps to handle a CRA GST/HST audit, ensuring compliance and minimizing potential adjustments.

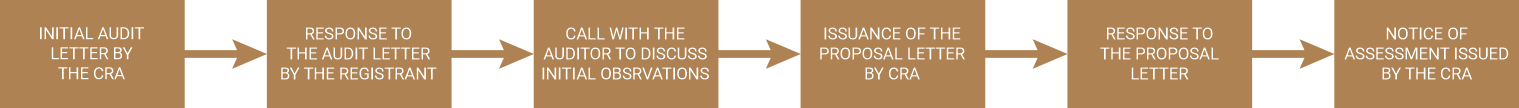

Step-by-Step Guide to Managing a GST/HST Audit

1. Respond Promptly to the Initial Audit Letter

The CRA’s initial audit letter is your first point of contact and should never be ignored. It typically includes a list of requested information and a due date for submission.

Clarify Requests: If any part of the request is unclear, contact the CRA auditor using the phone number provided in the letter. CRA auditors are generally helpful in clarifying requirements.

Request Extensions if Needed: If you require additional time to gather information, reach out to the auditor before the due date to request an extension. In our experience, the CRA is flexible, often granting 2–4 weeks, provided you explain the delay courteously.

2. Organize and Submit Information Clearly

When submitting documents, present them in a well-organized manner to facilitate the auditor’s review.

Include a Cover Letter: Accompany your submission with a cover letter summarizing the provided documents and their relevance.

Ensure Clarity: Arrange information logically to make it easy for the auditor to follow, reducing the likelihood of misunderstandings.

3. Engage Proactively with the Auditor

After submitting your initial response, take proactive steps to maintain open communication.

Follow Up: Contact the auditor to confirm receipt of your submission and express your willingness to provide clarifications or additional information. Request a discussion before the CRA issues a proposal letter, as auditors may proceed directly to adjustments without prior consultation.

Avoid Assumptions: Do not provide immediate answers to queries without verifying facts. Request time to review and respond accurately to avoid errors.

4. Review and Respond to the Proposal Letter

The CRA auditor may issue a proposal letter outlining proposed adjustments to your GST/HST return. This letter provides an opportunity to address discrepancies before a formal notice of assessment is issued.

Understand the Adjustments: Carefully review the proposed changes and supporting rationale.

Seek Professional Assistance: Responding to a proposal letter often involves complex legal submissions and knowledge of CRA administrative relief policies, such as wash penalty relief or relief for late self-assessments. Engaging a professional can help you leverage these policies, which are not automatically applied unless specifically requested.

Meet Deadlines: Like the initial letter, the proposal letter comes with a due date. Request extensions if needed and submit a detailed response addressing each adjustment, supported by facts and documentation.

5. Handle the Notice of Assessment

Once the CRA reviews your response to the proposal letter, they will issue a notice of assessment (NOA). If no adjustments are proposed, the NOA may be issued directly after the initial submission.

Agree with the NOA: If you accept the adjustments, pay any demanded amount. You may explore options to recoup GST/HST by issuing tax-only invoices to customers, as permitted under section 231.1 of the Excise Tax Act. Consider the following:

• GST/HST-Registered Customers: Customers entitled to full input tax credits (ITCs) are generally amenable to paying tax-only invoices but may have cashflow concerns. Work with them to address these.

• Non-Registered or B2C Customers: These customers may resist payment despite legal obligations. Consult a lawyer to explore your options.

• Contract Review: Check customer contracts to determine if quoted prices are GST/HST-inclusive.

• Time Limits: For supplies made over four years ago, provide customers with a copy of the NOA to enable them to claim ITCs.

Disagree with the NOA: If you dispute the assessment, file a notice of objection within 90 days of the NOA date. Refer to our page on “GST/HST Notice of Objection” for detailed guidance.

Key Tips for Success

Maintain Open Communication: Be transparent and responsive with the CRA auditor to build trust and avoid escalation.

Seek Professional Help When Needed: Complex audits or proposal letter responses benefit from professional expertise to navigate legal and administrative nuances.

Act Promptly: Adhere to deadlines or request extensions proactively to avoid penalties or rushed submissions.

Why It Matters

A well-handled GST/HST audit can prevent costly adjustments and ensure compliance. By following these steps, you can approach the audit with confidence, minimize disruptions, and address any issues effectively.

For further assistance or to schedule a free consultation, contact us to discuss your audit and explore how we can support you through the process.